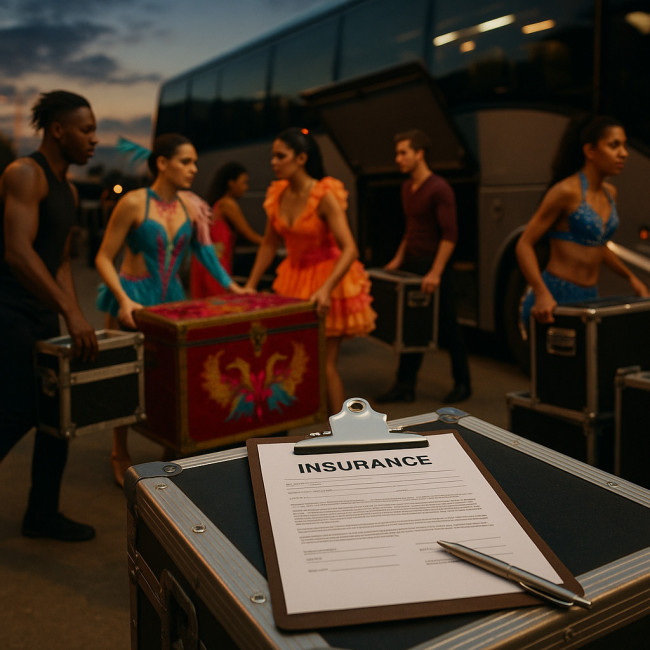

Touring dancer insurance: event policies safeguarding gear, health and fees

Touring dancer insurance keeps your show on the road even when injury, lost costumes or a cancelled date try to stop the music. This guide clarifies the covers, costs and quick-action tips you need before the tour bus leaves the depot.

Why every touring dancer needs dedicated cover

Most travel or company health plans exclude professional performances. Touring dancers face extra risks: packed venues, fast transfers, unfamiliar stages and overnight gear storage. A single sprained ankle or stolen costume can erase weeks of fees. Purpose-built insurance replaces income, protects your body and pays for emergency costume rebuilds so the run continues.

- Health and accident costs soar abroad, and national health systems rarely reimburse foreign performers.

- Custom costumes can exceed €3 000 each; replacing even one overnight strains cash flow.

- Venue contracts often shift liability to the act—without insurance you pay damages if a light stand you knock over injures a spectator.

Contracts matter too. Before signing any one-night gig, revisit clause wording. Our deep dive on one-night dance gig clauses shows where hidden liabilities hide.

Main risks to cover on tour

Stage injuries and medical bills

A slipped knee during a tech run may ground you for weeks. Medical and accident cover handles hospital fees, rehabilitation and emergency repatriation. Look for policies that pay “loss of earnings” for each missed rehearsal or show day—typically €100–€250 daily up to 52 weeks.

Theft, loss or damage to costumes and props

Tour bus break-ins are common. Insure costumes, personal dance shoes, props and specialist tech gear. Verify the “in-vehicle overnight” clause; many insurers only pay when the vehicle is in a locked, CCTV-monitored compound.

Cancelled shows and lost fees

Extreme weather, industrial strikes or sudden venue insolvency can wipe a date from the calendar. Cancellation cover reimburses non-refundable travel, hotel blocks and lost performance fees. Pair it with our tour logistics checklist to cut hidden costs.

Key touring dancer insurance policies

| Policy | Core protection | Typical limit | Average premium* |

|---|---|---|---|

| Personal accident & medical | Injury, illness, repatriation, loss of earnings | €100 000 medical / €50 000 accident | €12–€18 per dancer per week |

| Equipment & costume | Theft, loss or damage on tour, in transit and on stage | €25 000 per tour | €6–€10 per €1 000 insured value |

| Public liability | Third-party injury or property damage caused by the act | €5 000 000 | €150–€220 per year worldwide |

| Cancellation & non-appearance | Lost fees, prepaid travel, venue costs | Up to €100 000 per date | 2–4 % of potential gross fee |

| Travel disruption | Delayed flights, lost baggage, alternative transport | €5 000 per trip | Often bundled with medical cover |

*Indicative European rates 2024. Individual quotes vary by territory, experience and claim history.

Step-by-step: build the right cover package

- Check contractual obligations. Most festivals demand minimum liability limits. Cross-reference every venue agreement.

- Audit your gear. List each costume, prop and piece of tech with serial numbers and values. Photograph everything for quick claims.

- Estimate maximum earnings at risk. Tot up show fees, per diems and guaranteed merch advances. Set cancellation limits to cover that sum.

- Compare specialist brokers. Prioritise companies serving performing artists. They understand gear depreciation and rehearsal schedules.

- Read the territorial clause. “Worldwide excluding USA/Canada” is common; add those regions if your tour crosses the Atlantic.

- Bundle for discounts. A combined policy often costs 15 % less than standalone covers.

Practical tips to avoid claims in the first place

- Store costumes in flame-retardant garment bags and never under tour-bus bunks.

- Use Impact-resistant cases rated IP-67 for props and stage tech.

- Warm-up protocols cut injury rates by 30 %. Share short routines via group chat before load-in.

- Log each rehearsal in a digital health journal. Early pain reports speed treatment and bolster any future claim evidence.

- Film backstage for safety reviews. Our guide to event-day risk management shows simple phone-rig setups.

Claims process: what to expect

Speed is king. Notify the insurer within 24 hours, even if details are incomplete. Supply:

- Police report for theft or loss.

- Original receipts or pro-forma invoices for gear.

- Signed medical report for injury.

- Cancellation confirmation from the promoter.

Most specialist insurers pay straightforward gear claims in 7-10 working days. Medical or liability claims can take longer because external experts review records.

Real-world example

During a three-week European run, a dancer tore her meniscus. She claimed €3 600 in missed show fees, €1 400 medical bills and €850 physiotherapy. Her personal accident cover paid the full amount within 12 days, letting the company hire an understudy without cash-flow stress.

Where to find reputable insurers

Start with performing-arts broker directories, union recommendations and fellow company referrals. For fast comparisons, many dancers browse event dancer listings and filter providers by region and policy type. Always check claim response ratings, not just price.

Quiz: test your insurance readiness

FAQ

- Do I still need insurance if the promoter says I'm covered under their policy?

- Yes. Promoter policies focus on audience and venue liabilities. Your personal medical bills, gear loss and lost fees usually remain uncovered.

- Can a freelance soloist get the same cover as a full company?

- Absolutely. Insurers offer modular packages starting with a single dancer. Rates scale with declared gear value and earnings.

- How far in advance should I buy cover?

- Purchase as soon as dates are confirmed. Cancellation cover only reimburses costs incurred after the policy start date.

- Will pre-existing injuries be excluded?

- Most insurers exclude claims directly linked to a documented pre-existing condition unless you disclose it and pay a higher premium.

- Can I pause the policy when the tour ends?

- Many providers offer short-term “tour blocks” from one week. Annual cover is cheaper if you tour more than 12 weeks a year.

Next steps

Protecting your body and artistry is non-negotiable. Review your contracts, list your gear, then request at least two specialist quotes today. For deeper tour planning, explore our guide to live-streaming your dance events. Safe travels and powerful performances!

Call to action: Ready to compare policies? Download our free checklist and collect competitive quotes in under 30 minutes.