Graphiste smart-contract royalties 2025: automate recurring income streams

Tired of one-off payments? In 2025, graphic designers can embed royalty clauses directly in blockchain smart contracts and collect income every time their work changes hands. This guide shows you how to structure, deploy and optimise smart-contract royalties so money keeps flowing while you create your next masterpiece.

Why recurring royalties are a game-changer for graphic designers

Traditional licenses often stop paying once the initial term ends. A smart contract, however, executes royalty rules forever. Each resale of your poster, icon pack or NFT triggers an automatic split, sending funds to your wallet in seconds. No middleman, no invoice chase, just passive revenue you can forecast.

- Immediate cash flow: crypto transfers clear faster than bank wires.

- Transparent ledger: buyers see your royalty percentage up-front.

- Global reach: collectors pay in stablecoins from any country.

- Programmable logic: scale from one design to an entire series.

How smart-contract royalties work in practice

The basic architecture

A smart contract is a self-executing code block on a blockchain such as Ethereum or Polygon. You define:

- Token standard (ERC-721, ERC-1155) to represent your artwork.

- Royalty function compliant with

EIP-2981so marketplaces read the rate. - Withdrawal address—usually your hardware-wallet public key.

Marketplace support

Not every platform honours royalties. Check the table below before minting.

| Marketplace | Royalty Cap | Blockchain | Payout Speed |

|---|---|---|---|

| OpenSea | Up to 10 % | Ethereum, Polygon | Instant after sale |

| Rarible | Up to 50 % | Ethereum, Tezos | Instant |

| Foundation | 10 % | Ethereum | Weekly batch |

| Objkt | 25 % | Tezos | Instant |

| Blur | Variable (opt-in) | Ethereum | Instant |

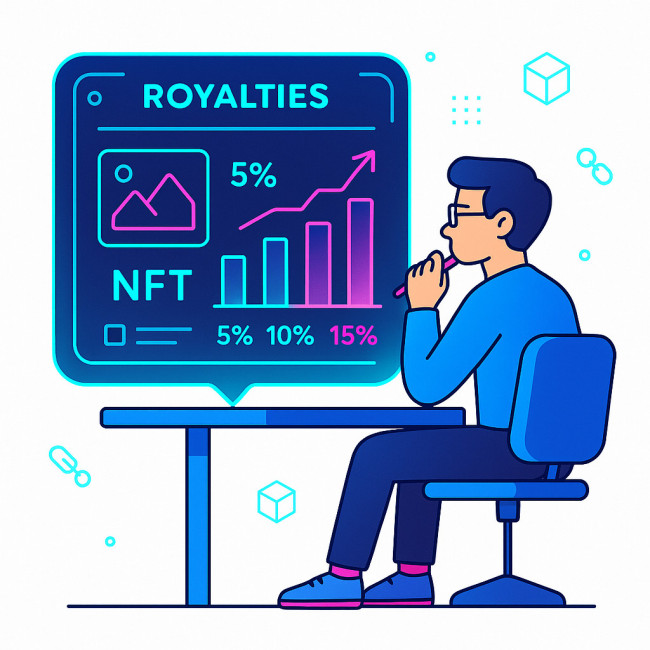

Choosing the right royalty percentage

Common rates range from 5 % to 15 %. Higher percentages look attractive, but they may drive traders to fee-free markets. Analyse your niche and audience size. Limited art editions can justify 15 %. Mass-market icon packs fare better at 5 %. Remember that each blockchain has its own culture: Ethereum collectors often accept higher fees as a badge of artist support, whereas fast-flipping traders on Polygon optimise every basis point, so choose pragmatically to avoid losing sales momentum while still honouring your creative worth. To validate your decision, back-test historical sales data with a simple spreadsheet: enter sale price, royalty cut, gas fees and projected volume, then simulate scenarios at multiple tiers; the sweet spot is where cumulative revenue peaks without scaring away secondary-market arbitrageurs.

Source : Dune Analytics Report

Step-by-step: deploy your first royalty smart contract

Before diving into the granular checklist, it helps to visualise the entire deployment journey from a bird's-eye perspective. You will move through four distinct phases: legal clearance, code customisation, network testing and market distribution. Each phase contains multiple checkpoints—rights audits, parameter tuning, simulated sales, explorer verification and multichannel listing—that collectively ensure your royalties trigger flawlessly and route funds to the correct wallets. Skipping any one of these steps can expose you to lost revenue, broken metadata or even contract exploits, so approach the process methodically. Plan adequate time for debugging, gather collaboration signatures early, budget for gas fluctuations and document every transaction hash for future tax reporting. When you treat deployment like a mini-product launch rather than a single button click, you dramatically increase the odds of long-term passive income and collector trust.

1. Audit your intellectual property

Confirm you own full rights to the graphic. For complex brand collaborations, review long-term display rights clauses before minting.

2. Pick a contract template

Use open-source libraries such as OpenZeppelin's ERC2981. They are battle-tested and integrate with major wallets.

3. Customise parameters

- name: “Neon City Series”

- symbol: NCS

- royaltyReceiver: your wallet address

- royaltyFee: e.g., 750 (7.5 %)

4. Test on a testnet

Deploy to Goerli or Mumbai first. Verify royalties fire by selling to yourself for 0.01 ETH.

5. Verify contract on block explorer

Verified code boosts collector trust and helps marketplaces fetch royalty info automatically.

6. Mint tokens

Bulk-mint if you offer print-on-demand posters. One-of-one art can be single tokens.

7. List on royalty-friendly markets

Choose at least two platforms so secondary trades stay within royalty-enforced ecosystems. You can even link to your Artfolio designer profile to funnel buyers directly to verified listings.

Automating payouts and accounting

Once the contract is live, royalties accumulate in real time. Use a multi-sig wallet if you share revenue with collaborators. Export CSV logs via Etherscan API and import into your accounting software. This workflow reduces admin hours by 40 % compared with PayPal micro-invoices.

Tax considerations

Most countries treat crypto royalties as regular income. Keep a spreadsheet of fiat equivalents at the time of receipt. Some jurisdictions allow cost-basis deductions for gas fees.

Common pitfalls and how to avoid them

- Zero-royalty marketplaces: Traders may move tokens to bypass fees. Add a transfer-blocking clause to restrict movement.

- High gas: Batch transfers to minimise costs, or mint on energy-efficient chains like Tezos.

- Missing metadata: Store artwork on IPFS or Arweave to prevent broken images.

- Non-compliant code: Always run audits or use audited templates.

Future trends: royalties beyond NFTs

In 2025 we will see royalties baked into dynamic tokens that update colours or layers over time. Designers also experiment with soulbound tokens that prove client licenses without enabling secondary sales. Learn more about flexible royalty structures in our deep dive on limited-edition object royalty models.

Quick self-test: are you royalty-ready?

FAQ

- Can I add royalties to an artwork that is already minted?

- You cannot edit an immutable smart contract, but you can transfer the artwork to a new royalty-enabled wrapper contract and burn the original.

- What happens if a marketplace ignores EIP-2981?

- The royalty function returns the correct fee, yet the marketplace may choose not to pay. Stick to platforms that enforce royalties or code transfer restrictions.

- How do collaborators split royalties?

- Create a split contract that distributes incoming funds automatically to each wallet in pre-defined percentages.

- Are smart-contract royalties legal in every country?

- Yes, but local tax rules differ. Always declare crypto revenue to avoid penalties.

Take action now

Royalties can secure your creative future. Audit your portfolio, choose a royalty-friendly blockchain and deploy your first smart contract this week. When you are ready to scale, explore advanced licensing tactics in our guide to licensing surface patterns. Passive income is no longer a dream—it is one transaction away.